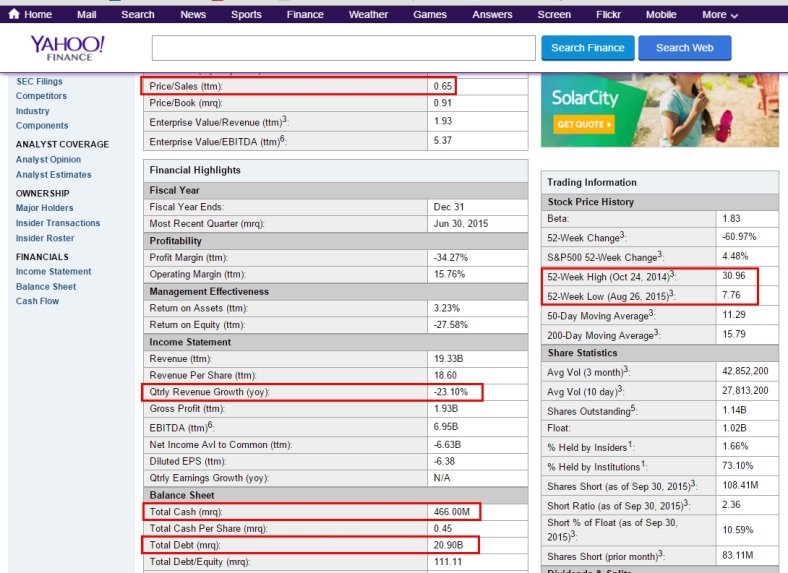

Buy Order

Here’s my latest trade, following my trading rules and schedule. Last night I put in this order to be filled. When I came back from work today, my order had been filled. I bought 5 Jan 2017 $80 call options for $15.5 (worth $7,750).

Fill Ticket

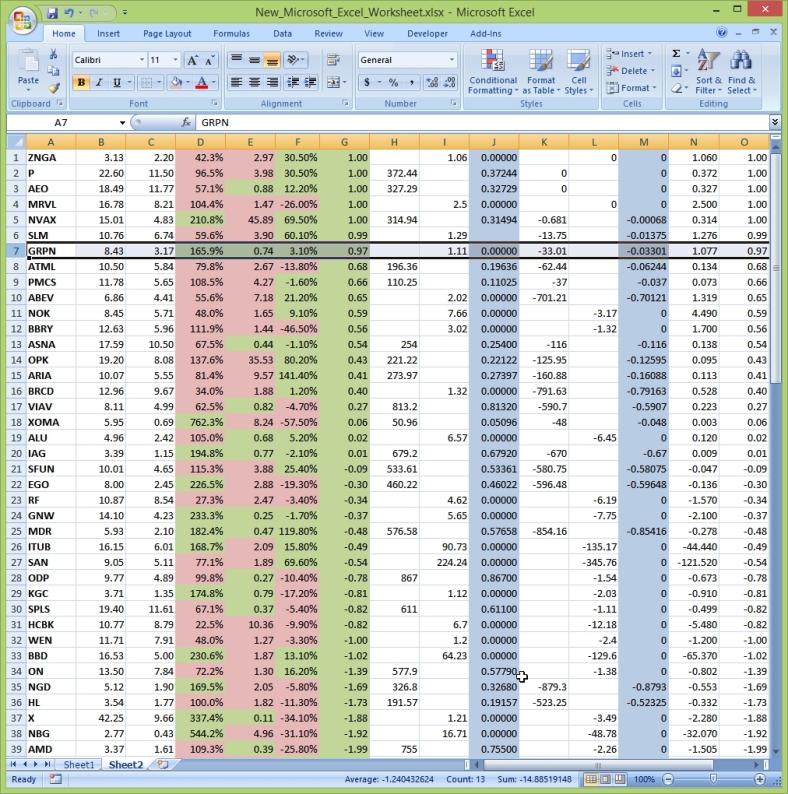

Record in Excel

As you can see I today bought 5 January 2017 $80 Strike WYNN calls. My cost for the calls was $7,750 (5 calls x 15.5 fill price x 100) plus $7.66 in commissions (you see now why I want to trade as little as possible?). My cash decreased by $7,757.66 to $84,831.97 my Options inventory cost (COGS) increased from $7,400 to $15,150, and my commission expenses for the year increased from $10.37 to $18.03.

These WYNN calls have 15.6 months until expiration which is: 1.3 years and 5 earnings events (so do my ARMH calls). Even if this trade goes south, I will only lose 7.75% of my total account’s value which is a sizable amount but not devastating. It’s an amount that I can recover from. My point is that I’m not playing the short-term game against the algorithms and supercomputers that have a direct fiber optic connection to the markets. You can’t compete against the big investment banks on speed or information. You have to play the long game because no matter how much speed or information the algos have they still can’t predict the future. So what you want to do is set yourself up in positions where you can just sit and wait and let the market move in your favor. Warren Buffet once said that investing is the transference of money from people with short-term thinking to those with longer-term thinking. So while most people are spending hundreds of dollars per year on commissions from day-trading, swing-trading, etc. I’m not doing shit. In 2 months I’ve spent less than $20 on commissions, I’m not jumping back and forth changing my mind 30 times a month on what to buy and sell, I’m just sitting here waiting for the market to move in my favor. And if it doesn’t, I’ll only lose a small amount of my cash and I’ll still have plenty of money left to put on 10 more trades.

Here’s a refresher on my investment rules:

- Only buy long term call options – this means no buying puts, no selling puts, no selling calls, no spreads, no calendars, no shorting stock, no buying stock, no ETFs, no nothing else. Only go long long term call options. That’s it.

- Only bet on stocks going higher – to reiterate my first rule, don’t short stocks, don’t sell calls, don’t buy puts.

- Only buy call options that have at least 365 (1 year until expiration) – I am playing long term trends here, I need to be able to ride out dips and I want to minimize my commissions cost by trading as little as possible. Play the long game.

- Diversify through time, not through industry or direction – Only put on new trades every 30 days. This means that, if I put on a new trade today 10/9/2015, I will not put on another trade until 11/8/2015, and I will not trade anything in between those two dates unless I am cashing in profits or closing a position. Essentially, I put on 1 new trade per month and do NOTHING else. It is also irrelevant if all of my positions are long or if they are all in companies in the same sector & industry.

- Whenever a position doubles in value, sell half it’s contracts – This means that if I buy 10 calls worth $1,000 when the value of those calls double to $2,000 I will sell 5 calls and to recoup my initial investment and lock in a “free trade”. Play with the house’s money. In general, do this every time a position doubles in value. So if those remaining 5 calls worth $1,000, in pure profit, double in value again, sell another 2 or 3 calls to lock in more gains but always try to leave some of the position on until expiration.

- Never risk more than 1/12th or your account value on any one trade – this means if you have a $100,000 account, divide that by 12, you can never put on a trade where you can lose more than $8,333. In other words, This will ensure that when you put on a bad trade you will never lose more than 8.33% of your account, which is a loss you can recover from.

- Record everything! – log all of your trades and the context around them. Write down why you made the trade. Use and excel spreadsheet and log everything, this is how you will know when your winners have doubled again. Log your thoughts on this blog. Take screen shots and again, tell yourself why, what reasons your are using to justify this trade. This is how you will learn from your mistakes.

The reason I only bet on stocks going higher is very simple. A stock can realistically go up more than 100%. Many stocks every single year go up more than 200% during that time. However, stocks can only go down until they reach zero, that’s the bottom and they can’t go any lower, there’s a limit. There’s no limit to the upside. Stocks can only go down 100% & then that’s it. Not only that but for various reasons betting on a company’s demise and cashing in on it is an extremely difficult thing to do.

Since this is a new account, it’s literally going to take me an entire year before I put most of my capital to work in trades. This is because I diversify through time and not through industry or direction (long vs short). I only put on a new trade every 30 days, so all of my positions are always 30 days or more apart. It’ll will take a while for the account to be fully operational and “up and running” and if you’re new to trading it might take you a while to understand why I am using this strategy. But eventually, after a couple of months I’m going to be harvesting profits from the seeds (trades I’m putting on today) while simultaneously planting new seeds in the future, every 30 days. So a year from now I could have multiple positions where I’m cashing in, selling calls to lock in profits and bringing fresh cash into my account. Periodically new money will come into the account, through profits, and every 30 days money will go out to buy new “inventory” of calls. This puts me in a position where I will always have some cash on hand, I am putting on new trades every month, and I’m growing the account. If it doesn’t quite make sense, stick around and see how this progresses over the next few months.

S&P 500 October

As you can see the market has made a higher high and a higher low from it’s 12% “correction” in August. This essentially means that we have probably around 3 months were the market is just going to trend upwards. Essentially the “crisis has been averted” and it’s business as usual, the uptrend continues. Oil is still in a solid down trend with no signs of going higher.

Oil October

The US dollar is still in an uptrend. The main point of this blog is to prove to myself that I can make decisions that will cause my accounts value to at least double (100%) increase every year.